A campaign with tangible, lasting results

In 2010, the Association of Revenue and Customs (ARC), which represents the UK’s top 2,500 tax inspectors, decided to launch a campaign against planned government cuts to HM Revenue and Customs (HMRC). ARC wanted to show that cuts to HMRC’s budget, and its members’ jobs, would make the deficit worse not better, since senior tax inspectors bring in many times more money in tax revenue than the cost of their salaries.

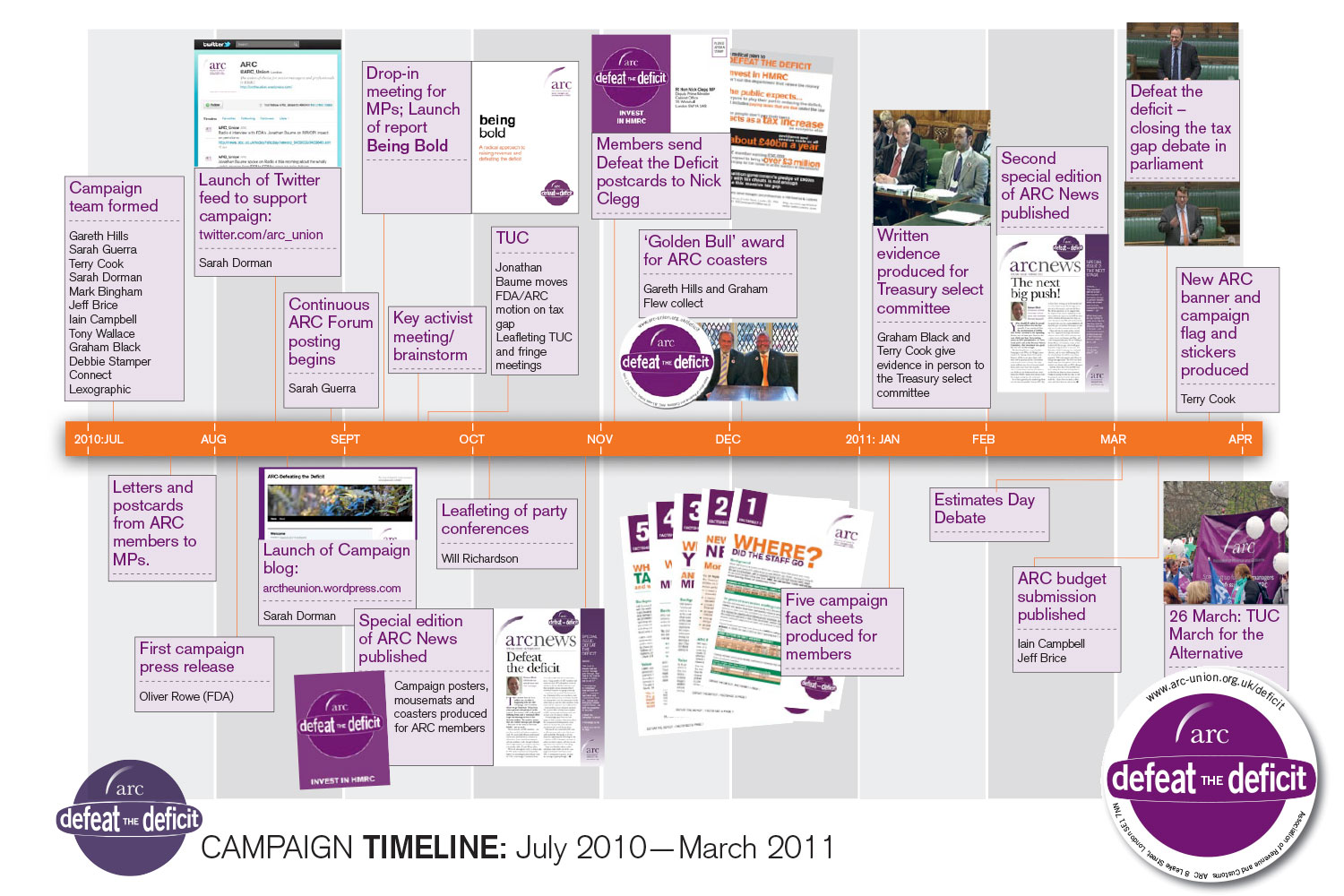

Our close relationship with ARC and knowledge of their work and members (we have produced their members’ magazine since 2007) meant we could support the campaign in a number of different ways from the start. We worked with the ARC president and campaign manager to develop a brand identity for the campaign — named “Defeat the Deficit” — and produced a range of publicity materials, including flyers and posters, T-shirts, stickers, coasters, lanyards, keyring torches and pens. We also published a series of factsheets and a special edition of the ARC members’ magazine to tie in with the campaign.

But the centrepiece of the campaign was an in-depth report, Being Bold: a radical approach to raising revenue and defeating the deficit, which explained how the government could cut the deficit by investing in the department. We helped to polish the copy and produced a clean and stylish report, with an eye-catching design featuring clear, simple charts and highlighted key points. The report was launched at a well-attended meeting for MPs and Peers at the House of Commons.

The Defeat the Deficit campaign was highly successful, attracting plenty of media attention and raising the profile of the union. It led to the ARC president appearing before the House of Commons Treasury select committee. The publicity led to a debate in the House of Commons in March 2011, during which many MPs from across the house backed the campaign against cuts to HMRC.

ARC officials are now regularly asked to brief MPs and give evidence to select committees, and the union has held several successful meetings for MPs and journalists. Interest in the issues raised by ARC's campaign remains high today.

But most important of all, the campaign yielded tangible results: in 2011, 2012 and 2013, HMRC received much better spending settlements than other government departments, and has been given an extra £1bn a year to crack down on tax avoidance and evasion. This investment yielded £24bn in extra revenue in 2013/14 – a clear vindication of ARC’s campaign.